This article will provide guidance on how to appoint officers of a Corporation and how resignations and removal of officers are documented.

The directors of a corporation manage the affairs of the corporation. As part of that management the directors are responsible for appointing officers to assist them with their duties.

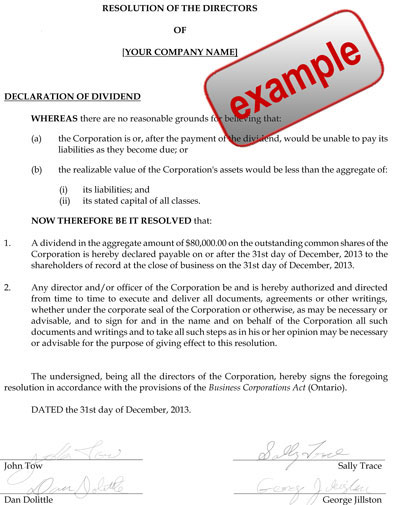

Directors can appoint officers at a meeting or a resolution can be signed by all of the directors appointing officers. For more guidance on preparing resolutions refer to directors resolutions. For guidelines on how directors can go about appointing officers at a meeting refer to directors meetings.

The statute of incorporation and the by-laws of a corporation will govern the manner in which officers can be appointed, removed or resign.

Appointing Officers

The directors initially approve the officers of the Corporation upon incorporation or each year at the annual meeting (see below for more information on annual resolutions/meetings).

An example of a resolution appointing officers is as follows:

Resignation of Officers

When an officer wishes to discontinue working with a company, that person will resign as an officer from the position he or she is holding. See an example of a resignation of an officer below:

Once a resignation has been received by the directors of a corporation, they will need to decide whether they wish to appoint another officer to replace the person resigning. Depending on the type of position, it may not be necessary to appoint a replacement. In situations where the directors wish to appoint a replacement officer, they will prepare a resolution in the form below:

Remove an Officer

The general operating by-law provides the manner in which an officer may be removed. The directors of a corporation will approve a resolution to remove the officer and appoint a replacement to that position. Below is an example of this form of resolution:

4-DR-Removing-an-OfficerAnnual Resolutions

Each year a company must approve certain matters. Officers may be excluded from appointment and new ones brought on at this time without being removed or resigning. For more information these approvals see annual resolutions.

For more information about officers titles refer to Officers Titles.

Notice of Change

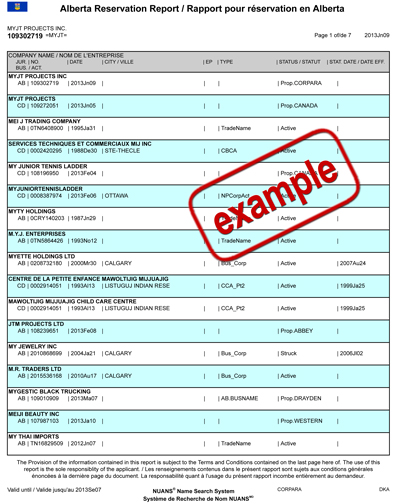

Most jurisdictions will provide in the governing statute that a notice of change must be filed to update the government’s database with respect to changes in officers and directors. In many cases this can be done online using a company that has access to the databases or a paper filing can be done. Paper filings are not as reliable but in most cases they are free to file.

Statute Reference:

Business Corporations Act (Ontario)

“1(1) “officer” means an officer designated under section 133 and includes the chair of the board of directors, a vice-chair of the board of directors, the president, a vice-president, the secretary, an assistant secretary, the treasurer, an assistant treasurer and the general manager of a corporation, and any other individual designated an officer of a corporation by by-law or by resolution of the directors or any other individual who performs functions for a corporation similar to those normally performed by an individual occupying any such office;

“senior officer” means,

(a) the chair of the board of directors, a vice-chair of the board of directors, the president, a vice-president, the secretary, the treasurer or the general manager of a corporation or any other individual who performs functions for a corporation similar to those normally performed by an individual occupying any such office, and

(b) each of the five highest paid employees of a corporation, including any individual referred to in clause (a);”

“117. (1) After incorporation, a meeting of the directors of a corporation shall be held at which the directors may,… (d) appoint officers;”

“127. (1) Subject to the articles or by-laws, directors of a corporation may appoint from their number a managing director or a committee of directors and delegate to such managing director or committee any of the powers of the directors. 2006, c. 34, Sched. B, s. 21 (1).”

Canada Business Corporations Act

“2(1) “officer” means an individual appointed as an officer under section 121, the chairperson of the board of directors, the president, a vice-president, the secretary, the treasurer, the comptroller, the general counsel, the general manager, a managing director, of a corporation, or any other individual who performs functions for a corporation similar to those normally performed by an individual occupying any of those offices;”

“104 (1) After issue of the certificate of incorporation, a meeting of the directors of the corporation shall be held at which the directors may…..(d) appoint officers;”

Business Corporations Act (Alberta)

“121. Subject to the articles, the bylaws or any unanimous shareholder agreement, (a) the directors may designate the offices of the corporation, appoint as officers individuals of full capacity, specify their duties and delegate to them powers to manage the business and affairs of the corporation, except powers to do anything referred to in section 115(3), (b) a director may be appointed to any office of the corporation, and (c) 2 or more offices of the corporation may be held by the same person.”

Business Corporations Act (British Columbia)

“141 (1) Subject to subsection (3) and to the memorandum and articles of a company, the directors may appoint officers and may specify their duties.

(2) Unless the memorandum or articles provide otherwise,

(a) any individual, including a director, may be appointed to any office of the company, and

(b) 2 or more offices of the company may be held by the same individual.

(3) An individual who is not qualified under section 124 to become or act as a director of a company is not qualified to become or act as an officer of the company.

(4) Unless the memorandum or articles provide otherwise, the directors may remove any officer.

(5) The removal of an officer is without prejudice to the officer’s contractual rights or rights under law, but the appointment of an officer does not of itself create any contractual rights.”

The Business Corporations Act (Saskatchwan)

“116 Subject to the articles, the bylaws or any unanimous shareholder agreement: (a) the directors may designate the offices of the corporation, appoint as officers persons of full capacity, specify their duties and delegate to them powers to manage the business and affairs of the corporation, except powers to do anything referred to in subsection (3) of section 110; (b) a director may be appointed to any office of the corporation; and (c) two or more offices of the corporation may be held by the same person.”

The Corporations Act (Manitoba)

“99(1). After the issue of the certificate of incorporation, a meeting of the directors of the corporation shall be held at which the directors may…..(d) appoint officers;”

By-law Provisions Regarding Officers

An example of a clause in a general operating by-law which governs how officers are appointed is as follows:

“Appointment – The board may from time to time designate the offices of the Corporation, appoint officers (and assistants to officers), specify their duties and, subject to the Act or the provisions of any unanimous shareholder agreement, delegate to such officers powers to manage the business and affairs of the Corporation. A director may be appointed to any office of the Corporation. Except for the chairman of the board and the managing director, an officer may but need not be a director. Two or more offices may be held by the same person.”

An example of a clause in a by-law which provides for the removal or resignation of an officer is as follows:

“ Term of Office (Removal) – In the absence of a written agreement to the contrary, the board may remove, whether for cause or without cause, any officer of the Corporation. Unless so removed, an officer shall hold office until his successor is appointed or until his resignation, whichever shall first occur.”

[margin_25t]

[margin_25t]