This Article will be specific to the annual corporate approvals (frequently called annuals or annual resolutions) required for companies incorporated pursuant to the Business Corporations Act (Ontario) and the Canada Business Corporations Act. Most other jurisdictions in Canada would have the same or similar requirements.

In order to document these approvals a series of resolutions are prepared and signed by the directors and shareholders of the company. Below is a breakdown of each document that is normally prepared and approved.

For more information about the rules of preparing and signing resolutions refer to Preparing Resolutions.[margin_30t]

Annual Resolutions can also be approved a meetings of the directors and shareholders and public companies will hold meetings each year to approve annual resolutions.

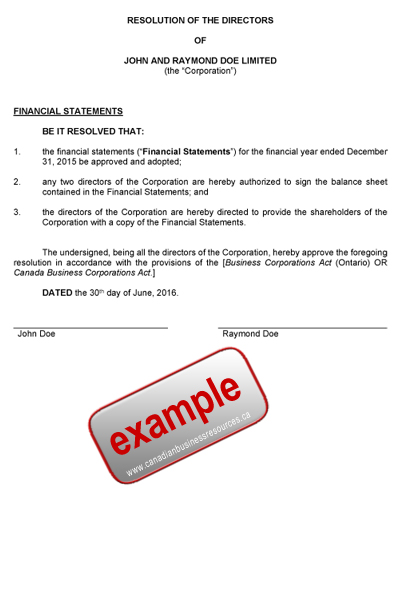

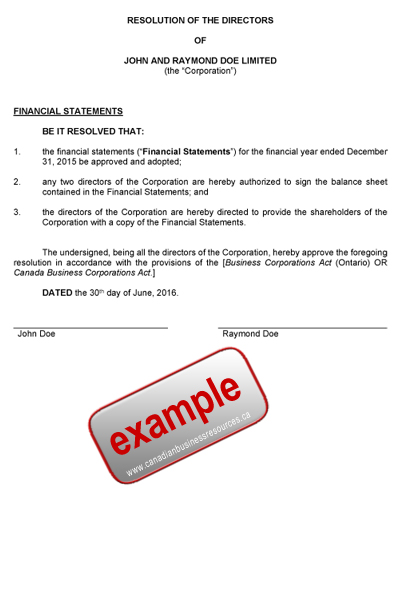

Approval of Financial Statements by Directors

All Canadian companies are required to file a federal tax return each year and as part of that procedure financial statements are prepared by the accountant of the Corporation.

As part of the annual resolutions, the directors of the Corporation must (a) approve the financial statements, (b) approve the directors executing the financial statements; and (3) approve the financial statements being shown to the shareholders. Below is a form of resolution that handles all three of these approvals:

Statute Reference:

Business Corporations Act (Ontario)

“Section 155. The financial statements required under this Act shall be prepared as prescribed by regulation and in accordance with generally accepted accounting principles. R.S.O. 1990, c. B.16, s. 155.”

“Section 159. (1) The financial statements shall be approved by the board of directors and the approval shall be evidenced by the signature at the foot of the balance sheet of any director authorized to sign and the auditor’s report, unless the corporation is exempt under section 148, shall be attached to or accompany the financial statements. R.S.O. 1990, c. B.16, s. 159 (1); 2010, c. 16, Sched. 5, s. 1 (2).”

Note: An offering corporation is a public corporation. Financial statements of public corporations must be audited. The above paragraph is referring to non-offering corporations, which are private corporations, and have an option to be audited or unaudited.

Canada Business Corporations Act

“Section 158 (1) The directors of a corporation shall approve the financial statements referred to in section 155 and the approval shall be evidenced by the manual signature of one or more directors or a facsimile of the signatures reproduced in the statements.”[margin_30t]

Acceptance of Financial Statements by Shareholders

Once the directors have approved the financial statements they are mandated to provide the shareholders with a copy of the financial statements. Below is an example of a shareholders resolution acknowledging receipt of the financial statements:

Statute Reference:

Business Corporations Act (Ontario)

“Section 154. (1) The directors shall place before each annual meeting of shareholders,….(a) in the case of a corporation that is not an offering corporation, financial statements for the period that began on the date the corporation came into existence and ended not more than six months before the annual meeting or, if the corporation has completed a financial year, the period that began immediately after the end of the last completed financial year and ended not more than six months before the annual meeting;”

Canada Business Corporations Act

“Section 155 (1) Subject to section 156, the directors of a corporation shall place before the shareholders at every annual meeting (a) comparative financial statements as prescribed relating separately to (i) the period that began on the date the corporation came into existence and ended not more than six months before the annual meeting or, if the corporation has completed a financial year, the period that began immediately after the end of the last completed financial year and ended not more than six months before the annual meeting, and (ii) the immediately preceding financial year;”[margin_30t]

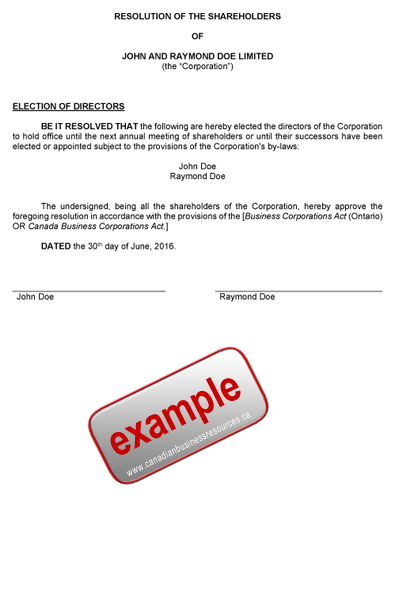

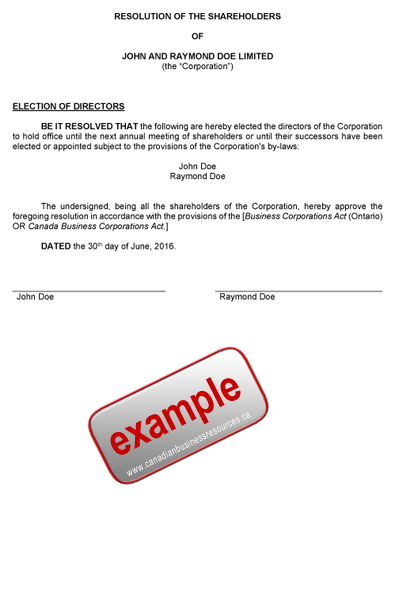

Election of Directors by Shareholders

The shareholders of the Corporation will elect the directors of the Corporation for the next year as part of the annual resolutions. Even if the directors are not changing a resolution should be prepared to elect the directors. If this resolution is not approved the current directors would still hold office.

Statute Reference:

Business Corporations Act (Ontario)

“Section 119 (4) Subject to clause 120 (a), shareholders of a corporation shall elect, at the first meeting of shareholders and at each succeeding annual meeting at which an election of directors is required, directors to hold office for a term expiring not later than the close of the third annual meeting of shareholders following the election. R.S.O. 1990, c. B.16, s. 119 (4).”

Canada Business Corporations Act

“Section 106(3) Subject to paragraph 107(b), shareholders of a corporation shall, by ordinary resolution at the first meeting of shareholders and at each succeeding annual meeting at which an election of directors is required, elect directors to hold office for a term expiring not later than the close of the third annual meeting of shareholders following the election.”[margin_30t]

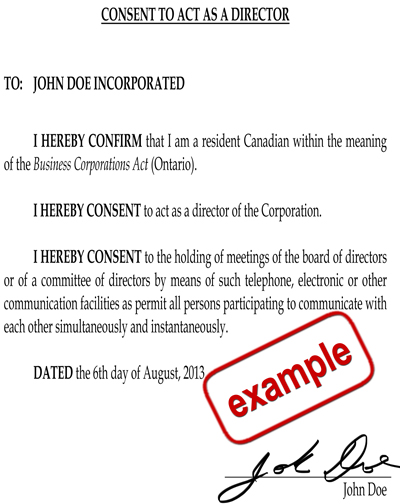

Consent to Act as a Director

Every director who is elected or appointed must consent to act as a director of the Corporation and agree in writing to act. A consent to act is only required to be provided once during the term of appointment, however, customarily these consents are included in the annual resolutions package.

25% of the directors must be resident Canadians and the consent confirms the residency.

The statute also provides that directors can hold meetings by electronic means provided the directors consent to such meetings.

Not just anyone can be a director of a corporation. Refer to Qualifications of Directors of Federal Companies and Qualifications of Directors of Ontario Companies for more information.[margin_15t]

Statute Reference:

Business Corporations Act (Ontario)

“Section 1(1) “resident Canadian” means an individual who is,

(a) a Canadian citizen ordinarily resident in Canada,

(b) a Canadian citizen not ordinarily resident in Canada who is a member of a prescribed class of persons, or

(c) a permanent resident within the meaning of the Immigration Act (Canada) and ordinarily resident in Canada;”

“Section 118(3) At least 25 per cent of the directors of a corporation other than a non-resident corporation shall be resident Canadians, but where a corporation has less than four directors, at least one director shall be a resident Canadian. 2006, c. 34, Sched. B, s. 19 (2).”

“Section 119(9) Subject to subsection (10), the election or appointment of a director under this Act is not effective unless the person elected or appointed consents in writing before or within 10 days after the date of the election or appointment. 1999, c. 12, Sched. F, s. 8.”

“Section 119(10) If the person elected or appointed consents in writing after the time period mentioned in subsection (9), the election or appointment is valid. 1999, c. 12, Sched. F, s. 8.”

“Section 119(11) Subsection (9) does not apply to a director who is re-elected or re-appointed where there is no break in the director’s term of office. 1999, c. 12, Sched. F, s. 8.”

“Section 126(13) Unless the by-laws otherwise provide, if all the directors of a corporation present at or participating in the meeting consent, a meeting of directors or of a committee of directors may be held by means of such telephone, electronic or other communication facilities as permit all persons participating in the meeting to communicate with each other simultaneously and instantaneously, and a director participating in such a meeting by such means is deemed for the purposes of this Act to be present at that meeting. R.S.O. 1990, c. B.16, s. 126 (13).”

Canada Business Corporations Act

“Section 2(1) resident Canadian means an individual who is (a) a Canadian citizen ordinarily resident in Canada, (b) a Canadian citizen not ordinarily resident in Canada who is a member of a prescribed class of persons, or (c) a permanent resident within the meaning of subsection 2(1) of the Immigration and Refugee Protection Act and ordinarily resident in Canada, except a permanent resident who has been ordinarily resident in Canada for more than one year after the time at which he or she first became eligible to apply for Canadian citizenship;”

“Section 106(9) An individual who is elected or appointed to hold office as a director is not a director and is deemed not to have been elected or appointed to hold office as a director unless (a) he or she was present at the meeting when the election or appointment took place and he or she did not refuse to hold office as a director; or (b) he or she was not present at the meeting when the election or appointment took place and (i) he or she consented to hold office as a director in writing before the election or appointment or within ten days after it, or (ii) he or she has acted as a director pursuant to the election or appointment.”

“Section 114(9) Subject to the by-laws, a director may, in accordance with the regulations, if any, and if all the directors of the corporation consent, participate in a meeting of directors or of a committee of directors by means of a telephonic, electronic or other communication facility that permits all participants to communicate adequately with each other during the meeting. A director participating in such a meeting by such means is deemed for the purposes of this Act to be present at that meeting.”[margin_30t]

Appointment of Officers by Directors

The directors elected at the annual meeting or by annual resolutions will then appoint the officers they wish to assist them for the next year. It can be the same officers as in the previous year. The form of approval is as follows:

Statute Reference:

Business Corporations Act (Ontario

“Section 133. Subject to the articles, the by-laws or any unanimous shareholder agreement, (a) the directors may designate the offices of the corporation, appoint officers, specify their duties and delegate to them powers to manage the business and affairs of the corporation, except, subject to section 184, powers to do anything referred to in subsection 127 (3); (b) a director may be appointed to any office of the corporation; and (c) two or more offices of the corporation may be held by the same person.”

Canada Business Corporations Act

“Section 121 Subject to the articles, the by-laws or any unanimous shareholder agreement, (a) the directors may designate the offices of the corporation, appoint as officers persons of full capacity, specify their duties and delegate to them powers to manage the business and affairs of the corporation, except powers to do anything referred to in subsection 115(3); (b) a director may be appointed to any office of the corporation; and (c) two or more offices of the corporation may be held by the same person.”[margin_30t]

Appointment of Accountant or Auditor

The shareholders of a Corporation will either appoint an accountant or appoint an auditor for the ensuing year. Below is the form of resolution that can be modified for either situation.

Statute Reference:

Business Corporations Act (Ontario)

“Section 149(2) The shareholders shall at each annual meeting appoint one or more auditors to hold office until the close of the next annual meeting and, if an appointment is not so made, the auditor in office continues in office until a successor is appointed. R.S.O. 1990, c. B.16, s. 149 (2).”

“Section 149(7) The remuneration of an auditor appointed by the shareholders shall be fixed by the shareholders, or by the directors if they are authorized so to do by the shareholders, and the remuneration of an auditor appointed by the directors shall be fixed by the directors. R.S.O. 1990, c. B.16, s. 149 (7).”

Canada Business Corporations Act

“Section 162 (1) Subject to section 163, shareholders of a corporation shall, by ordinary resolution, at the first annual meeting of shareholders and at each succeeding annual meeting, appoint an auditor to hold office until the close of the next annual meeting.”

“Section 162(4) The remuneration of an auditor may be fixed by ordinary resolution of the shareholders or, if not so fixed, may be fixed by the directors. 1974-75-76, c. 33, s. 156; 1978-79, c. 9, ss. 1(F), 4″[margin_30t]

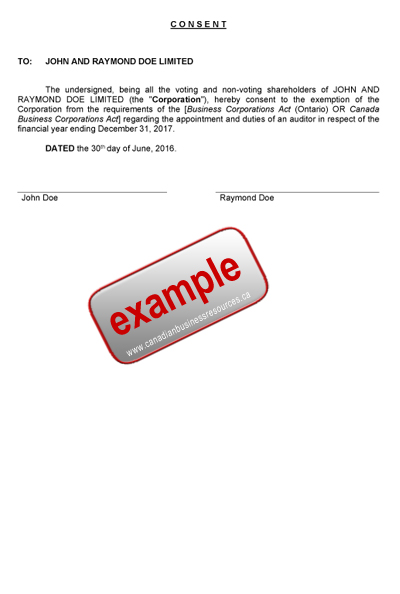

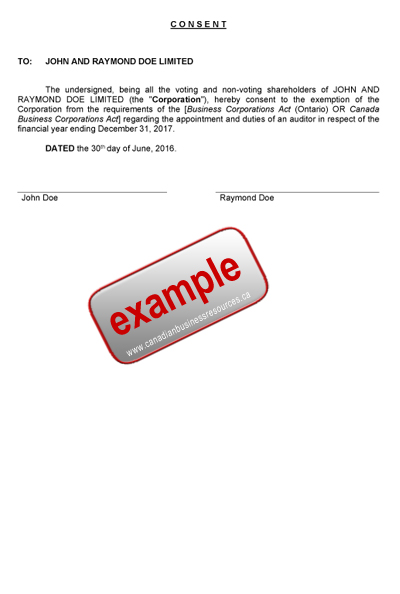

Consent to Non-Appointment of An Auditor

Most companies do not have their financial statements audited by an auditor. Instead they have financial statements prepared by an accountant. In those cases, the shareholders of the Corporation must approve the non-appointment of an auditor. This approval requires the consent of all of the voting and non-voting shareholders as follows:[margin_15t]

Statute Reference:

Business Corporations Act (Ontario)

Section 148. In respect of a financial year of a corporation, the corporation is exempt from the requirements of this Part regarding the appointment and duties of an auditor if, (a) the corporation is not an offering corporation; and (b) all of the shareholders consent in writing to the exemption in respect of that year. 1998, c. 18, Sched. E, s. 23.

Canada Business Corporations Act

Section 163 (1) The shareholders of a corporation that is not a distributing corporation may resolve not to appoint an auditor. 163 (2) A resolution under subsection (1) is valid only until the next succeeding annual meeting of shareholders. (3) A resolution under subsection (1) is not valid unless it is consented to by all the shareholders, including shareholders not otherwise entitled to vote.

Note: Reference to distributing corporation is another way of saying public corporation.

Appointment of Auditor

In the case where an auditor is being appointed for an upcoming financial year of the Corporation, the auditor should receive notice of its appointment as follows:[margin_20t]

Statute Reference:

Business Corporations Act (Ontario)

Section 149 (9) The corporation shall give notice in writing to an auditor of the auditor’s appointment forthwith after the appointment is made. R.S.O. 1990, c. B.16, s. 149 (9).

Canada Business Corporations Act

Silent

When Should Annual Resolutions Be Approved

The financial statements of a Corporation must be finalized and incorporated into the corporate tax return for the company within six months of the end of the financial year. Therefore, the annual resolutions cannot be dated prior to the financial statements being prepared and no later than six months after the financial year end.

Declaration of Dividends

As part of the preparation and approval of annual resolutions frequently dividends will be declared. For more information about how to approve a dividend refer to Declaring a Dividend.