Which Provinces Accept a NUANS report versus a Specific Province Name Clearance Report?

The province and territories which accept the NUANS report are: Alberta, Ontario, New Brunswick, Federal, Nova Scotia, Prince Edward Island and Yukon. All other jurisdictions in Canada will require a name search report specific to that province or territory.

In Alberta and Ontario you are not required to provide a name search report of any type for sole proprietorships, business names or partnerships, however, it is still advisable to perform a preliminary name search since the onus is on you to ensure the name has not been taken by any other business. If you are ordering a name search report or a name search specific to a province as required by the type of registration you are wanting, our service automatically includes preliminary name searches. The only time you would order a preliminary name search would be if you are registering a business name, sole proprietorship or partnership in a province that does not require a name search report such as Alberta or Ontario.

Name search reports and NUANS name search reports all provide the same kind of information. They determine whether a proposed name has been used by any other business across Canada and also provide a list of similar names already registered. Be advised that these reports are specific to the province they are ordered for. For instance a Federal NUANS report cannot be used for an Ontario company.

Purchase a NUANS Name Search Report

What is a Name Search Report

A name search report compares the name of a proposed business to all other names already registered across Canada.

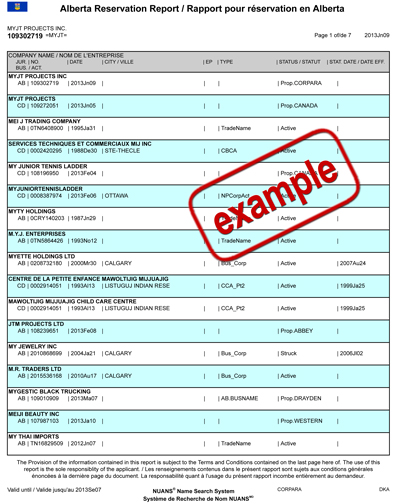

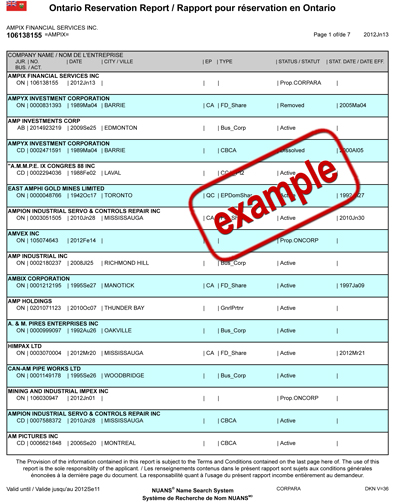

A NUANS report is specific to certain provinces and is a seven-page report which is generated from the search system which compares a proposed name or trade-mark with the database of existing names that have been registered anywhere across Canada.

What Information is Provided by a Name Search Report or a NUANS Report

By comparing the proposed name against the NUANS name search system or a name granting system in a province or territory, any similarity existing between the proposed name and the names in the database, will show up on the name search report. This will allow you to determine whether you are planning on using a name for your company that is too similar to another name. It is important for your name to be as distinct as possible. If you are ordering a name search for a province that does not accept the NUANS you will be provided with a name search that compares names to other names in that particular province or territory but the name search report will also look at similar names in other provinces right across Canada that may be a conflict.

What is A NUANS Search System

The NUANS search system is a computerized search system which contains a list of all of the company names, sole proprietorships, partnerships, business names and trade-marks registered in the federal, provincial and territorial jurisdictions in Canada. The purpose of the system is to keep track of all names registered across Canada.

Even if a province or territory has its own name search system in place, the NUANS system will pick up those names in its database and therefore when performing a preliminary name search the search system is the best way to get a pre-clearance of your name.

Only search houses can perform preliminary name searches or full NUANS name searches through the NUANS system with the exception of the federal government’s site which provides limited access to doing searches.

The federal website’s preliminary name search system is limited in that it does not allow for broad searches and it is not workable if ordering a Federal NUANS and it is limited with respect to doing preliminary name searches for other provinces and territories. In order to effectively do a preliminary name search on your proposed business you must have an experienced search house perform the search.

What is a Name Search Report and NUANS Report Used For

A NUANS name search report must accompany articles of incorporation when incorporating a company in the federal, Alberta, Ontario, New Brunswick, Prince Edward Island and Yukon jurisdictions of Canada.

NUANS reports are also required in some provinces for registration of business names and partnerships. In Ontario and Alberta you are not required to provide any form of name search when registering a sole proprietorship or partnership.

Do All Provinces and Territories Accept the NUANS Name Search

Some provinces and territories have their own name search system and they do not except the NUANS name search report. Those provinces and territories will require a name search specific to that jurisdiction. The jurisdictions in Canada that do not accept the NUANS report are British Columbia, Manitoba, Saskatchewan, Nunavut and Northwest Territories.

If you are registering a sole proprietorship, business name or partnership in a province or territory where a name search or NUANS report is not required (such as Ontario or Alberta), it is a good idea to perform a preliminary name search to ensure the name is available but a full name search report or NUANS report would not be necessary. All you need to do is ensure the name is available before you register your sole proprietorship or partnership.

Even though not all provinces and territories accept a NUANS report since all names registered in those jurisdictions are recorded in the NUANS database, it is still advisable to do a preliminary name search through the NUANS system to ensure the name is available. Resources for Canadian Business Owners can provide you with a preliminary name search for situations for situations when a full NUANS report is not required.

If you require a name search report or NUANS name search report to register your company, business name, sole proprietorship or partnership, Resources for Canadian Business Resources Inc. will provide you with unlimited free preliminary name searches when a name search report or NUANS report is ordered through us.

How Does the NUANS Name Search System Capture the Names from the Other Name Search Systems in Canada

The governments which do not accept reports from the NUANS name search system provide a list of any names that have been registered in their province or territory to the NUANS name search system and these names are added to the NUANS system database on a regular basis.

Why is a Name Search or NUANS Report Necessary

You cannot incorporate a company with a name that is exactly the same as another name already registered. It does not matter whether you are registering a company in PEI and the duplicate name is in BC, you will not be able to register an exact name.

When you go to incorporate a company the government must first know if that name has been taken. In order for the government to ensure that the name is free to use it needs to see a NUANS name search report or similar name search report depending on the jurisdiction.

The report will show the government whether there is an exact name already registered for the proposed name you wish to use. The name search report is also your way of determining whether there are additional conflicts to your name. The onus will be on you to look over the entire report and make sure you are not proposing to use a name that is even close to another corporate name or trade-mark since the owner of the name could still have a claim against you if your name is too similar and his or her company name has had a large presence in the marketplace for many years. Order a NUANS name search now.

How Do You Ensure Your Proposed Business Name is Distinct

Refer to the section on name guidelines for more information on how to ensure you have picked a distinct and descriptive name for your company that will not be challenged by the government or another company.

Are There Different Types of NUANS Name Search Reports

Each jurisdiction that accepts the NUANS Name search report will have its own form of NUANS report. If you are incorporating an Ontario company you will be required to obtain an Ontario NUANS Name Search report. If you are incorporating a federal company you will be required to obtain a federal NUANS name search report. If you are incorporating an Alberta company you will be required to obtain an Alberta NUANS Name Search report. Despite the fact that each of these reports is different, all reports will search the NUANS database system for similar names right across Canada.

Why Are Federal Name searches different from Alberta Name Searches, Ontario NUANS, PEI and NB Name Searches

An Ontario company can be incorporated with any name which is different in any regard, even if it is only a few letters in the name. A federal company differs however because when the federal government reviews articles of incorporation together with a Canada NUANS it will not allow any name which is similar to another company in many regards. When you are submitting incorporation documents for a federal company ensure your name is as different as possible from any other company name being used in Canada. Be prepared that the government may also disallow your proposed name if it sounds the same as another existing company even if the spelling is substantially different. You should be prepared that your name might not be accepted. Each time you submit articles for review you will need to submit a new NUANS report. If the first name you pick is too close to others on record, then you will have to buy another federal NUANS and submit again. A qualified search house will be able to assist you with having a better chance of your NUANS report being accepted the first time. Resources for Canadian Business Owners has experience in having proposed names accepted even after they have been rejected. However, some times additional searches must be performed to rule out conflicting companies and there can be an additional cost here. It is possible to obtain an advance Name Decision report from Industry Canada before you submit your articles for filing. Resources for Canadian Business Owners will be glad to submit a request for a Name Decision for your federal incorporation. This will also include as many preliminary name searches as you require without further cost. We are experienced in reviewing preliminary name search results through the NUANS system to help increase your chances of being accepted the first time round when you are submitting articles of incorporation for companies in the federal jurisdiction.

Why Does It Matter if I use a Name Similar to a Name in Another Province

It may seem that if you are registering a company in Ontario and another company in the Northwest Territories has a similar name, that this should not be a problem. With technology as it is today, companies are conducting business across Canada, if not across the World. You will have no idea whether the company with the name that you are proposing may at some time in the future be conducting business in the very province you wish to register in and then there would be a conflict. Further, the Canadian government provides that any company that is registered in any province or territory in Canada can apply to be registered to carry on business in another province or territory. It is therefore very important that your proposed name is distinct and descriptive. This is called an extra-provincial registration.

Is a NUANS Report Required for a Business Name or Sole Proprietorship Registration

A NUANS Report is not required in Ontario and Alberta, and some other provinces when registering business names, sole proprietorships and partnerships. In Ontario and Alberta anyone can register the exact same business name or sole proprietorship as one registered already. However, it is advisable that you do a preliminary NUANS name search before you register to ensure no one else is using the name regardless. This is the one time when you should pay for a preliminary name search for your business name. There is no need to purchase a full NUANS report or other name search report for a business name, sole proprietorship or partnership being registered in Alberta and Ontario. All that is required is to do a preliminary name search just to ensure you are picking a name that is different. It is always advisable not to use a name that is too similar to another name since this would be a conflict for your business in the long run. Some business names such as “Bell Canada” have a high standing in the marketplace because of the number of years the name has been registered and the number of people who know the name.

You should be aware that there is no such thing as a Federal Business Name registration, Federal partnership registration or Federal Sole Proprietorship registration. Business names, partnerships and sole proprietorships are governed by the provincial and territorial jurisdictions in Canada.

What is a Preliminary NUAN Name Search

If you purchase a NUANS Name Search Report and the name you wish to use for your incorporation is on the report as registered for another company or business, you will not be allowed to incorporate with that name. It is therefore important that you do a preliminary NUANS name search first in order to ensure before hand that the name is free. Otherwise, if you do not first ensure a pre-check of the name is done and you order a full NUANS report or other form of name search report, your registration could be rejected if the name is too similar or the same as another name registered.

Please note however that preliminary NUANS Name Searches are not fool proof and there is always a chance a conflict will show up on the full NUANS Name Search or other name search report that did not come up during the Preliminary NUANS Name Search.

You can keep buying full NUANS Name Search reports but it will become costly. It is better that you check the name first with a Preliminary NUANS Name search. Resources for Canadian Business Owners provides FREE UNLIMITED preliminary name searches with the purchase of a NUANS or Name Search Report. We will make great efforts to pre-clear your name in advance so that the odds of your proposed name being rejected are reduced.

How do I Arrange to have a Preliminary Name Search

Resources for Canadian Business Owners Inc. will do as many preliminary Name Searches as you wish with the purchase of a full NUANS Name Search or other Name Search Report. If you are not required to submit a name search report with your registration Resources for Canadian Business Owners will be glad to perform a preliminary name search for you at a nominal fee. This service should only be used when a name search report is NOT required

How Long Does it Take to Get a Name Search or NUANS Report

If you are ordering a report from a province or territory that does not accept a NUANS report, it can take a few days to a week to obtain the report. If you are ordering a NUANS name search report, it takes from 40 minutes to three hours to obtain a NUANS Name Search Report. Once you order a NUANS report a confirmation email will be sent to you to let you know that we have received your request. Depending on the number of searches requested at that time it might take us 40 minutes or three hours. Be assured though you will receive the NUANS in the same day whether you order it at 6:00 a.m. in the morning or 10:00 p.m. at night. Frequently we have someone close to the computer for most of the day right up until late evening so feel free to contact us at any time of the day. We are open 7 days a week. We look forward to serving you.

How Long is a Name Search or NUANS Report in effect.

A NUANS name search report will be in effect for 90 days from the date of issue. If yuou do not use the report until after that time you will be required to order a new one and most other name search reports are also effective for a similar length period.

Name Searches for Non-Profit Corporations and Charities

We can provide you with information about registered companies, partnerships, sole proprietorships or operating trade names on the public record throughout Canada including extensive due diligence searching and reporting.

We also provide registration services for Canadian companies, sole proprietorships, partnerships and operating trade names in the provinces and territories of Canada.

Our staff has over 30 years’ experience in corporate law and we will be glad to answer your questions. We take pride in our work and will provide you with the best, fastest, accurate and reasonably priced service available.

Depending on the province or territory you wish to incorporate your non-profit corporation will depend on the type of name report that you get. There is no difference between a name search report for a not for profit corporation or charitable corporation and a share corporation. It is the province or territory that governs the report you get.

For instance, a name search report for a share company being incorporated in Ontario is the same report given to a non profit or charity corporation wishing to incorporate in Ontario, being an Ontario NUANS name search report.

NUANS Search Houses are trained on the best method of performing Preliminary NUANS Name Search reports in order to ensure that the most conflicts to your proposed names can be found prior to ordering a full NUANS Name Search Report.

If you incorporate a numbered company a NUANS name search report will not be required since the government will provide you with the next number in line. An example of a numbered Ontario company would be a corporation having a name such as 9999999 Ontario Inc.

A numbered federal company might be a corporation with a name called 9999999 Canada Inc. and an Alberta numbered company might be 2244444 Alberta Ltd. The numbers are given out consecutively. You cannot choose the number for your company.